Latest Version

Version

4.41.23.0

4.41.23.0

Update

November 22, 2024

November 22, 2024

Developer

UniCredit Bank

UniCredit Bank

Categories

Finance

Finance

Platforms

Android

Android

Downloads

0

0

License

Free

Free

Package Name

hr.asseco.android.jimba.mUCI.sme.hu

hr.asseco.android.jimba.mUCI.sme.hu

Report

Report a Problem

Report a Problem

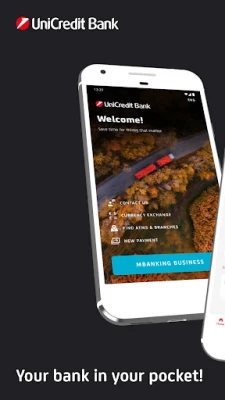

More About UniCredit mBanking Business

After signing the contract in the bank branch office, you can activate the mBanking service of the UniCredit mBanking Business small business mobile application. You can log in to the service faster and authenticate transactions with biometric identification on devices capable of reading fingerprints and face recognition.

The functions of UniCredit mBanking Business:

• Functions based on authorization levels

• Later and multiple signature option

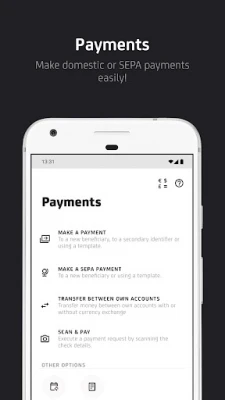

• Payment

• Request to pay

• Qvik instant payment solutions (QR-code, NFC and deeplink)

• Transfer between own accounts, even with currency conversion

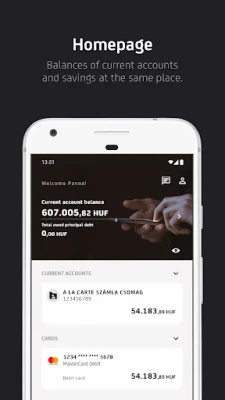

• Checking the status of account balances and savings

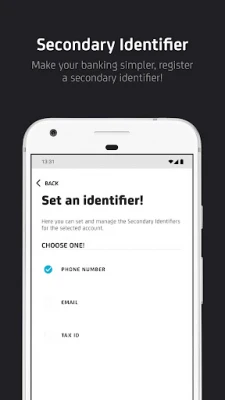

• Register, modify, and delete secondary IDs

• Activation of debit card

• Temporary suspension and unsuspension of debit card

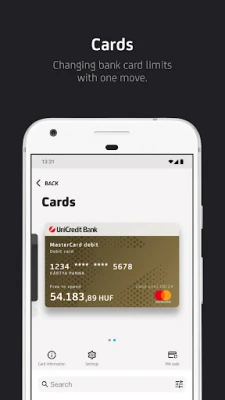

• Debit Card limit modification

• Debit card registration to Google Pay

• Login and transaction-signing with fingerprint

• Managing Standing Orders (new and existing)

• Creating, deleting, editing direct debit forms

• SEPA transactions

• Scan & Pay

• Term Deposit

• Monthly e-statements

• View PIN of debit and/or credit cards

• Push notifications about incoming transactions when money is transferred to your account

Other functions:

Exchange rates

• Functions based on authorization levels

• Later and multiple signature option

• Payment

• Request to pay

• Qvik instant payment solutions (QR-code, NFC and deeplink)

• Transfer between own accounts, even with currency conversion

• Checking the status of account balances and savings

• Register, modify, and delete secondary IDs

• Activation of debit card

• Temporary suspension and unsuspension of debit card

• Debit Card limit modification

• Debit card registration to Google Pay

• Login and transaction-signing with fingerprint

• Managing Standing Orders (new and existing)

• Creating, deleting, editing direct debit forms

• SEPA transactions

• Scan & Pay

• Term Deposit

• Monthly e-statements

• View PIN of debit and/or credit cards

• Push notifications about incoming transactions when money is transferred to your account

Other functions:

Exchange rates

Rate the App

Add Comment & Review

User Reviews

Based on 0 reviews

No reviews added yet.

Comments will not be approved to be posted if they are SPAM, abusive, off-topic, use profanity, contain a personal attack, or promote hate of any kind.

More »

Popular Apps

Santander Inversiones Uruguay 5Banco Santander Uruguay

Santander Empresas Portugal 5Banco Santander Totta S.A.

Mi Tarjeta SantanderBanco Santander Uruguay

Santander ArgentinaBanco Santander (Argentina)

Santander Empresas ARBanco Santander (Argentina)

Santander EmpresasBanco Santander (Brasil) S.A.

SantanderSignSantander Consumer Bank AG (Deutschland)

Santander mobileSantander Bank Polska S.A.

Santander InternationalSantander International

Santander Way: App de cartõesBanco Santander (Brasil) S.A.

More »

Editor's Choice

Grim Soul: Dark Survival RPG 5Brickworks Games Ltd

Craft of Survival - Gladiators 5101XP LIMITED

Last Shelter: Survival 5Long Tech Network Limited

Dawn of Zombies: Survival GameRoyal Ark

Merge Survival : Wasteland 5StickyHands Inc.

AoD Vikings: Valhalla Game 5RoboBot Studio

Viking Clan: Ragnarok 5Kano Games

Vikings: War of Clans 5Plarium LLC

Asphalt 9: Legends 5Gameloft SE

Modern Tanks: War Tank Games 5XDEVS LTD