Latest Version

Version

1.5.0

1.5.0

Update

November 22, 2024

November 22, 2024

Developer

İsmail NURAL

İsmail NURAL

Categories

Finance

Finance

Platforms

Android

Android

Downloads

0

0

License

Free

Free

Package Name

com.riskrewardratio

com.riskrewardratio

Report

Report a Problem

Report a Problem

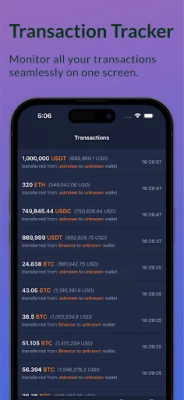

More About 3R Calculator - Risk & Reward

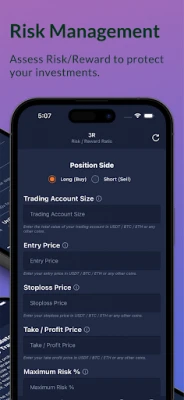

Risk management is probably the most important part of a trading strategy, without it, you risk losing your whole equity. This calculator is a great tool for any new or expert crypto trader. It will show you exactly how much you should invest in amount, percentage, and lot (unit) size.

The calculator works great on Bitcoin, Ethereum, Binance Coin, and any other cryptocurrency. You can also use it to calculate your lot sizes for traditional markets like Bonds, Stocks, Forex. Anything that you can trade, this calculator will do the job whether you are going Long or Short!

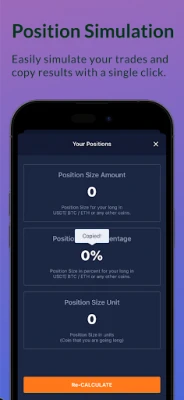

If the position size is greater than your equity, the calculator will display all the info that you need in order to open a position with Leverage.

How to calculate your crypto position size

The formulas to calculate your position sizes require 4 elements:

1. Account Size

This is the total USDT, Bitcoin, Ethereum or any other crypto that you use for your trading.

Include any open trade and update your account size once your trade is exited.

Example: You have 1000 USDT, you open a trade with a position size of 100 USDT. For your next trade, you will still use the 1000 USDT to calculate your Position Size. Once your trade is closed whether, in profit or loss, you will then update your Account Size by adding the profit or loss of that close trade.

2. Entry Price

This is the Limit price at which your trading strategy tells you to go Long or Short.

If you are entering your trade using a Market order, use an approximation of your entry price. Make it the worst entry price, like there will be slippage. By doing this, you will protect yourself from a real surprise if the market is highly volatile.

3. Stoploss Price

This is the price of your first stop-loss that would get hit if the position goes against you. If you don’t know where your stop-loss should be, learn how to determine your crypto stop-loss. Opening a trade without knowing your stop-loss is a terrible idea and will only get you rekt sooner or later.

Maximum Risk % – This is the maximum risk in percentage that you are willing to take for each trade. This is really up to you, but I would suggest that you start with a risk % between 0.5% and 1.5%.

Even if that seems pretty small, unless you know exactly the best risk per trade because you have backtested and forward tested your strategy, 0.5%-1.5% will keep your equity safe from the high volatility of the crypto market.

Using these 4 elements, we will be able to get our position size in Amount (USDT, BTC, ETH), in percent (% of our account size), and in Units (ADA, XRP, TRX, LINK).

If the position size is greater than your equity, the calculator will display all the info that you need in order to open a position with Leverage.

How to calculate your crypto position size

The formulas to calculate your position sizes require 4 elements:

1. Account Size

This is the total USDT, Bitcoin, Ethereum or any other crypto that you use for your trading.

Include any open trade and update your account size once your trade is exited.

Example: You have 1000 USDT, you open a trade with a position size of 100 USDT. For your next trade, you will still use the 1000 USDT to calculate your Position Size. Once your trade is closed whether, in profit or loss, you will then update your Account Size by adding the profit or loss of that close trade.

2. Entry Price

This is the Limit price at which your trading strategy tells you to go Long or Short.

If you are entering your trade using a Market order, use an approximation of your entry price. Make it the worst entry price, like there will be slippage. By doing this, you will protect yourself from a real surprise if the market is highly volatile.

3. Stoploss Price

This is the price of your first stop-loss that would get hit if the position goes against you. If you don’t know where your stop-loss should be, learn how to determine your crypto stop-loss. Opening a trade without knowing your stop-loss is a terrible idea and will only get you rekt sooner or later.

Maximum Risk % – This is the maximum risk in percentage that you are willing to take for each trade. This is really up to you, but I would suggest that you start with a risk % between 0.5% and 1.5%.

Even if that seems pretty small, unless you know exactly the best risk per trade because you have backtested and forward tested your strategy, 0.5%-1.5% will keep your equity safe from the high volatility of the crypto market.

Using these 4 elements, we will be able to get our position size in Amount (USDT, BTC, ETH), in percent (% of our account size), and in Units (ADA, XRP, TRX, LINK).

Rate the App

Add Comment & Review

User Reviews

Based on 0 reviews

No reviews added yet.

Comments will not be approved to be posted if they are SPAM, abusive, off-topic, use profanity, contain a personal attack, or promote hate of any kind.

More »

Popular Apps

Santander Inversiones Uruguay 5Banco Santander Uruguay

Santander Empresas Portugal 5Banco Santander Totta S.A.

Mi Tarjeta SantanderBanco Santander Uruguay

Santander ArgentinaBanco Santander (Argentina)

Santander Empresas ARBanco Santander (Argentina)

Santander EmpresasBanco Santander (Brasil) S.A.

SantanderSignSantander Consumer Bank AG (Deutschland)

Santander mobileSantander Bank Polska S.A.

Santander InternationalSantander International

Santander Way: App de cartõesBanco Santander (Brasil) S.A.

More »

Editor's Choice

Grim Soul: Dark Survival RPG 5Brickworks Games Ltd

Craft of Survival - Gladiators 5101XP LIMITED

Last Shelter: Survival 5Long Tech Network Limited

Dawn of Zombies: Survival GameRoyal Ark

Merge Survival : Wasteland 5StickyHands Inc.

AoD Vikings: Valhalla Game 5RoboBot Studio

Viking Clan: Ragnarok 5Kano Games

Vikings: War of Clans 5Plarium LLC

Asphalt 9: Legends 5Gameloft SE

Modern Tanks: War Tank Games 5XDEVS LTD