Latest Version

Version

0.2.347

0.2.347

Update

February 01, 2025

February 01, 2025

Developer

Transactree Services Private Limited

Transactree Services Private Limited

Categories

Finance

Finance

Platforms

Android

Android

Downloads

0

0

License

Free

Free

Package Name

in.lendbox.perannum

in.lendbox.perannum

Report

Report a Problem

Report a Problem

More About Per Annum: P2P Lending App

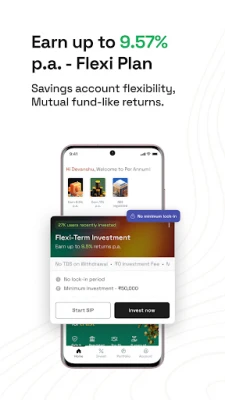

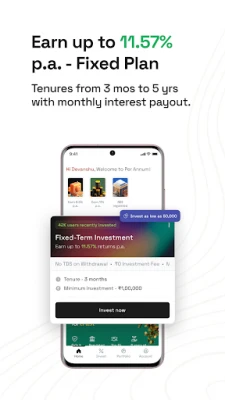

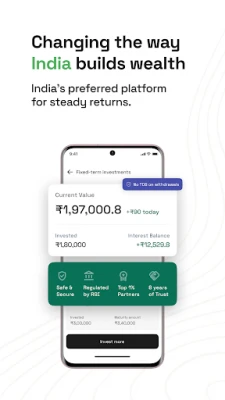

Per Annum is India's smartest lending app that lets you grow your savings with higher annual returns. Lend now and diversify your portfolio with non-market linked asset-classes.

Earn 2x of traditional fixed return investments. Lend in highly curated tranches consisting of India's most premium borrowers, filtered through an unmatched risk mitigation mechanism by highly experienced professionals with record of 100% on-time repayment history. Unlike Mutual funds and stock market, your returns at Per Annum are immune to any market linked volatility.

What is Per Annum?

Per Annum is building India’s largest platform for alternate debt products, unlocking a large basket of options previously unavailable to the Indian retail investor.

Our goal is to introduce the Indian retail investor to products beyond the traditional, fixed income products which barely beat the prevailing inflation rate. It is time that the Indian investors gets access to products that are immune to the volatility of the stock markets all the while earning a healthy return.

How does it work?

Per Annum follows stringent risk assessment processes to screen assets and partners before they go live on the platform. Parameters such as each partner’s vintage, financial status and history, future plans, team size and team experience amongst many others are taken into account along with the asset type, domestic and international benchmarks on returns on the assets and overall asset history and quality. On average, our team onboards only 10% of the partners of all the partners being assessed at any given time.

The experience for the lender is extremely seamless by a single page sign up, and transferring funds into your choice of plan and simply transferring the funds.

Why lending with Per Annum?

✦ Earn XIRR of 9%-14%

✦ Paperless KYC and verification

✦ Rigorous partner and asset screening

✦ End-to-end recovery and legal support

✦ 100% transparent and easy to use

To know more, contact us at +91-7291029298

*Above mentioned returns are indicative. Actual returns depend on performance of underlying loans. P2P lending is subject of credit risk and repayments are not guaranteed.

What is Per Annum?

Per Annum is building India’s largest platform for alternate debt products, unlocking a large basket of options previously unavailable to the Indian retail investor.

Our goal is to introduce the Indian retail investor to products beyond the traditional, fixed income products which barely beat the prevailing inflation rate. It is time that the Indian investors gets access to products that are immune to the volatility of the stock markets all the while earning a healthy return.

How does it work?

Per Annum follows stringent risk assessment processes to screen assets and partners before they go live on the platform. Parameters such as each partner’s vintage, financial status and history, future plans, team size and team experience amongst many others are taken into account along with the asset type, domestic and international benchmarks on returns on the assets and overall asset history and quality. On average, our team onboards only 10% of the partners of all the partners being assessed at any given time.

The experience for the lender is extremely seamless by a single page sign up, and transferring funds into your choice of plan and simply transferring the funds.

Why lending with Per Annum?

✦ Earn XIRR of 9%-14%

✦ Paperless KYC and verification

✦ Rigorous partner and asset screening

✦ End-to-end recovery and legal support

✦ 100% transparent and easy to use

To know more, contact us at +91-7291029298

*Above mentioned returns are indicative. Actual returns depend on performance of underlying loans. P2P lending is subject of credit risk and repayments are not guaranteed.

Rate the App

Add Comment & Review

User Reviews

Based on 0 reviews

No reviews added yet.

Comments will not be approved to be posted if they are SPAM, abusive, off-topic, use profanity, contain a personal attack, or promote hate of any kind.

More »

Popular Apps

UFCU Mobile 5UFCU

Santander Empresas ARBanco Santander (Argentina)

Santander Inversiones Uruguay 5Banco Santander Uruguay

Santander BrasilBanco Santander (Brasil) S.A.

Santander Way: App de cartõesBanco Santander (Brasil) S.A.

Santander mobileSantander Bank Polska S.A.

Mi Tarjeta SantanderBanco Santander Uruguay

Santander ArgentinaBanco Santander (Argentina)

Santander EmpresasBanco Santander (Brasil) S.A.

Santander Brasil 5Banco Santander (Brasil) S.A.

More »

Editor's Choice

Grim Soul: Dark Survival RPG 5Brickworks Games Ltd

Craft of Survival - Gladiators 5101XP LIMITED

Last Shelter: Survival 5Long Tech Network Limited

Dawn of Zombies: Survival GameRoyal Ark

Merge Survival : Wasteland 5StickyHands Inc.

AoD Vikings: Valhalla Game 5RoboBot Studio

Viking Clan: Ragnarok 5Kano Games

Vikings: War of Clans 5Plarium LLC

Asphalt 9: Legends 5Gameloft SE

Modern Tanks: War Tank Games 5XDEVS LTD