Latest Version

Version

4.41.118

4.41.118

Update

December 28, 2024

December 28, 2024

Developer

Beacon Credit Union, Inc.

Beacon Credit Union, Inc.

Categories

Finance

Finance

Platforms

Android

Android

Downloads

0

0

License

Free

Free

Package Name

com.softek.ofxclmobile.Beaconcu

com.softek.ofxclmobile.Beaconcu

Report

Report a Problem

Report a Problem

More About Beacon Mobile Banking

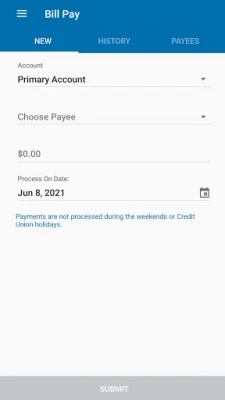

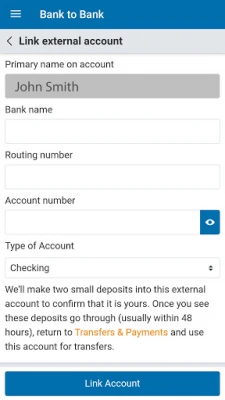

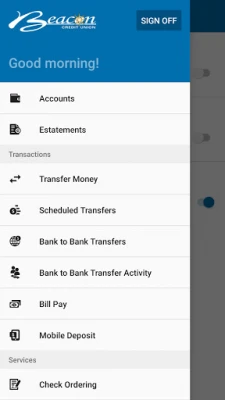

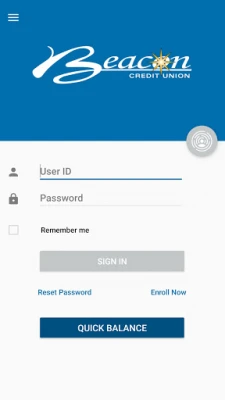

Beacon Mobile Banking allows you to check balances, view transaction history, transfer funds, and pay loans on the go!

Features:

- Check Balances

- View Transaction History

- Transfer Funds

- Pay Loans

- Secure Messaging for support

If you have any questions about this application, please contact Beacon Credit Union at 434-237-1566.

Our current members may be eligible to apply for loans with Beacon Credit Union. Please review the following to understand our lending information, and make sure to check https://www.mybcu.org/rates/loan-rates for the latest rate information.

Our personal loans have a minimum repayment period of 6 months and a maximum repayment period of 96 months. The Maximum Annual Percentage Rate (APR) for a personal loan is 36%. Our minimum offered loan amount is $1000 and our maximum offered loan amount is $100,000.

Not all applicants may qualify for the most favorable rates or the highest possible loan amounts. Approval and actual loan terms depend on credit union membership history and credit risk evaluations (including responsible credit history, debt-to-income information, and availability of collateral). Highly qualified applicants may be offered higher loan amounts and/or lower APRs. Personal loans may not be used for college or post-college education expenses, business or commercial purposes, buying crypto or other speculative investments, gambling, or illegal purposes. Active-duty military, their spouses or dependents covered by the Military Lending Act may not pledge a vehicle as collateral.

Consider a loan where the borrower receives $10,000 at an APR of 24.99% over 48 months.

The borrower would repay $331.52 every month.

The total amount paid for the loan would be $15,912.74.

Actual loan terms may vary and depend on the prospective borrower’s credit profile, debts, income, membership history, etc.

Some of our loan options are intended for consolidating existing debts into a single loan. When consolidating existing debts or refinancing an existing loan, total finance charges and money owed over the period of the new loan may be more than the existing debt due to longer terms or higher interest rates.

- Check Balances

- View Transaction History

- Transfer Funds

- Pay Loans

- Secure Messaging for support

If you have any questions about this application, please contact Beacon Credit Union at 434-237-1566.

Our current members may be eligible to apply for loans with Beacon Credit Union. Please review the following to understand our lending information, and make sure to check https://www.mybcu.org/rates/loan-rates for the latest rate information.

Our personal loans have a minimum repayment period of 6 months and a maximum repayment period of 96 months. The Maximum Annual Percentage Rate (APR) for a personal loan is 36%. Our minimum offered loan amount is $1000 and our maximum offered loan amount is $100,000.

Not all applicants may qualify for the most favorable rates or the highest possible loan amounts. Approval and actual loan terms depend on credit union membership history and credit risk evaluations (including responsible credit history, debt-to-income information, and availability of collateral). Highly qualified applicants may be offered higher loan amounts and/or lower APRs. Personal loans may not be used for college or post-college education expenses, business or commercial purposes, buying crypto or other speculative investments, gambling, or illegal purposes. Active-duty military, their spouses or dependents covered by the Military Lending Act may not pledge a vehicle as collateral.

Consider a loan where the borrower receives $10,000 at an APR of 24.99% over 48 months.

The borrower would repay $331.52 every month.

The total amount paid for the loan would be $15,912.74.

Actual loan terms may vary and depend on the prospective borrower’s credit profile, debts, income, membership history, etc.

Some of our loan options are intended for consolidating existing debts into a single loan. When consolidating existing debts or refinancing an existing loan, total finance charges and money owed over the period of the new loan may be more than the existing debt due to longer terms or higher interest rates.

Rate the App

Add Comment & Review

User Reviews

Based on 0 reviews

No reviews added yet.

Comments will not be approved to be posted if they are SPAM, abusive, off-topic, use profanity, contain a personal attack, or promote hate of any kind.

More »

Popular Apps

Santander Empresas ARBanco Santander (Argentina)

Santander Inversiones Uruguay 5Banco Santander Uruguay

Santander Empresas Portugal 5Banco Santander Totta S.A.

UFCU Mobile 5UFCU

Mi Tarjeta SantanderBanco Santander Uruguay

Santander ArgentinaBanco Santander (Argentina)

Santander mobileSantander Bank Polska S.A.

Santander EmpresasBanco Santander (Brasil) S.A.

Santander BrasilBanco Santander (Brasil) S.A.

SantanderSignSantander Consumer Bank AG (Deutschland)

More »

Editor's Choice

Grim Soul: Dark Survival RPG 5Brickworks Games Ltd

Craft of Survival - Gladiators 5101XP LIMITED

Last Shelter: Survival 5Long Tech Network Limited

Dawn of Zombies: Survival GameRoyal Ark

Merge Survival : Wasteland 5StickyHands Inc.

AoD Vikings: Valhalla Game 5RoboBot Studio

Viking Clan: Ragnarok 5Kano Games

Vikings: War of Clans 5Plarium LLC

Asphalt 9: Legends 5Gameloft SE

Modern Tanks: War Tank Games 5XDEVS LTD